Delta Air Lines pulls guidance for record profits due to trade war

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Delta Air Lines has pulled its guidance for record profits this year, blaming “a lack of economic clarity” about the fallout from President Donald Trump’s sweeping tariffs, as major US businesses weigh the damage from a deepening trade war.

The Atlanta-based carrier on Wednesday went from forecasting its best financial year in January to warning of rising uncertainty from an escalating global trade war that is hurting already fragile consumer confidence.

Presenting quarterly results on Wednesday, chief executive Ed Bastian said it would be “premature” to update the airline’s full-year guidance, having previously forecast pre-tax profits of $6bn this year.

As US earnings season begins, the update offers an early insight into how major companies are navigating Trump’s tariffs, coming on top of warnings from US airlines earlier this year about falling demand for domestic travel amid rising uncertainty about the economic outlook.

In January, Delta said it was expecting record annual profits this year, amid passengers’ continued willingness to pay for premium seats. But two months later, it sounded the alarm on corporate and consumer spending and slashed its first-quarter sales and earnings forecasts.

On Wednesday, Bastian said that “with broad economic uncertainty around global trade, growth has largely stalled”, adding that the airline was “protecting margins and cash flow by focusing on what we can control”. As part of that aim, Delta will hold flying capacity at last year’s level in the second half of the year instead of increasing it, as well as “actively managing costs” and capital expenditure.

The update follows warnings of a slowdown from airlines including American Airlines, United Airlines and Southwest Airlines in March, spurred by reduced travel by government workers and rising uncertainty among US households, which now face higher prices as a result of Trump’s trade war.

The airline sector is a bellwether for the wider economy, with customers generally cutting back on travel when feeling anxious and splurging on flights when in a strong financial position.

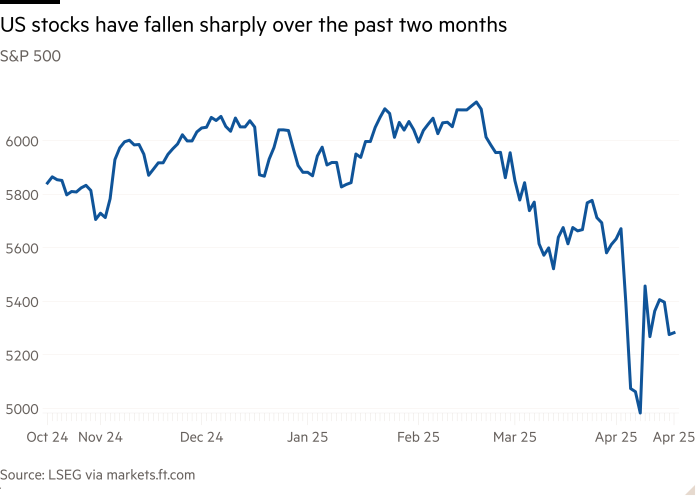

Trump’s tariffs have already hit the technology, automotive and consumer goods industries because of the impact on their international supply chains, hammering stock prices and threatening to add costs that companies may pass on to consumers.

The impact on airlines is less direct, but the sector is likely to point to signs of wider economic pain, as consumers divert spending from travel to more necessary goods that increase in price.

“A smart consumer is moving up purchases of cars, electronics and clothes before the tariffs jack up the price,” said industry analyst Brett Snyder, who publishes the Cranky Flier website. He added that consumers were likely to “shift their already reduced spending plan away from travel”.

Delta said it expected to earn between $1.5bn and $2bn in the second quarter, having reported a 7 per cent decline in first-quarter operating income year on year, to $569mn.

It said it earned an adjusted 46 cents per share in the first quarter, falling within the range of the reduced forecast it laid out last month. It had originally expected to earn between 70 cents and $1 per share between January and March.

It added: “Given our position of strength . . . and the decline in fuel prices, Delta remains well positioned to deliver solid profitability and free cash flow for the year.”