Scott Bessent, the Treasury secretary shaping Trump’s trade war

At a cabinet meeting on Thursday, as US equity indices showed new signs of distress at Donald Trump’s trade policies, the president turned to Scott Bessent for an update on the markets.

“I don’t . . . see anything unusual today,” the Treasury secretary responded, trying to offer Trump some comfort by citing lower inflation figures, a decline in oil prices, a well-received US bond auction and the expected positive outcome of talks to defuse tensions with America’s big trading partners.

“We will end up in a place of great certainty over the next 90 days on tariffs,” he promised.

That may be wishful thinking on the part of the 62-year-old former hedge fund manager from South Carolina.

Treasury secretaries before him have faced bouts of serious economic and financial trouble, from Tim Geithner and Hank Paulson during the financial crisis to Steven Mnuchin and Janet Yellen at the height of the pandemic. But Bessent is charged with managing the repercussions of a shock delivered to the world by the president he works for, after Trump imposed across-the-board duties of 10 per cent on a wide range of imported goods from around the world, higher tariffs on many major trading partners and massively increased levies on China.

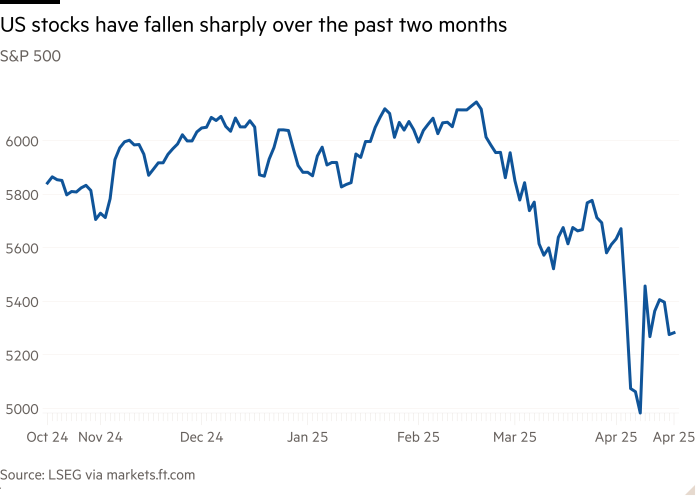

While Trump abruptly rolled back some of his plans this week in response to investor pressure, US asset prices have continued to suffer. Bessent risks becoming known for presiding over not only America’s detachment from the global economy, but a self-inflicted hit to US markets, which could jeopardise the dollar’s status as the world’s reserve currency.

“We may be headed for a serious financial crisis wholly induced by US government tariff policy,” Lawrence Summers, former US Treasury secretary, wrote on X earlier this week.

To his supporters, however, Bessent has emerged as a potential saviour, the most senior official standing between Trump and a full-blown global trade war, in an administration otherwise stacked with hardliners. After he met with Trump in Florida last Sunday, the US president opened the door to talks with Japan and South Korea, putting Bessent in charge. Bessent was also in the Oval Office on Wednesday when Trump announced a 90-day pause in the steepest tariffs, with the exception of China.

“He’s the perfect person to bring President Trump’s agenda back on course, so that we don’t tank the economy or the financial markets,” says Michael Oliver Weinberg, a professor of finance and economics at Columbia University’s Business School. “Some people in the administration are not as knowledgeable on economics, markets, booms and busts, whereas Scott is”.

Bessent was born in 1962 in Conway, near the coastal city of Myrtle Beach, South Carolina. His father was a property investor and his mother helped run the family’s businesses.

At Yale University, he obtained a degree in political science before developing a passion for finance: his first big break came in the early 1990s when he joined Soros Fund Management, run by billionaire liberal investor George Soros. From the London office, he played a key role in the group’s lucrative bet against the pound.

“Scott was the person on the ground in London, really providing the economic basis, rationale and thesis for why Britain would have to exit the exchange rate mechanism,” said Weinberg. During a second stint working for Soros, Bessent led another successful bet — this time against the Japanese yen.

In 2011, he married John Freeman, a former New York prosecutor: they have two children and recently sold their multimillion-dollar historic pink mansion in Charleston, South Carolina. “If you had told me in 1984, when we graduated, and people were dying of Aids, that 30 years later I’d be legally married and we would have two children via surrogacy, I wouldn’t have believed you,” he told Yale alumni magazine in 2015.

In 2015, Bessent left Soros to found Key Square Group, his own hedge fund. The move coincided with his growing support for Trump’s political aspirations. He donated to Trump’s 2017 inauguration and became a major campaign donor in 2024 — embracing his pitch of tax cuts and deregulation. “He’s always had money,” said one financier who is close to him. “He’s lived well — private planes, beautiful homes.”

Following Trump’s second win, Bessent’s champion to become Treasury secretary was Stephen Bannon, the political strategist. “He’s my guy,” Bannon wrote in a text message to the FT. “A ‘War Room’ contributor for 2 years — Maga loves him,” Bannon added, referring to the podcast he now hosts.

Bessent has not had an easy ride in his first few months in office. Trump tasked him with securing a deal with Ukraine to secure access to its minerals and natural resources. It has yet to be signed. The S&P 500 index is down 13 per cent since he was sworn in, and the 10-year Treasury bond yield, the market indicator he watches most closely, has risen slightly despite the sell-off — suggesting investors are losing faith in its safe-haven status. Democrats have attacked him as hapless and aloof. “We need a Treasury secretary who is in the real world,” said Elizabeth Warren this week.

The jury is still out on whether Bessent will be able to shape Trump’s trade war in a way that will be palatable to markets, the economy and foreign governments. “He’s always been a very private person, working in small teams . . . under the radar,” said the financier who knows him. “And now, suddenly he’s this high-profile public figure at the centre of absolute chaos.”

Additional reporting by Myles McCormick

james.politi@ft.com, amelia.pollard@ft.com, james.fontanella@ft.com