Could Trump fire the Federal Reserve chair?

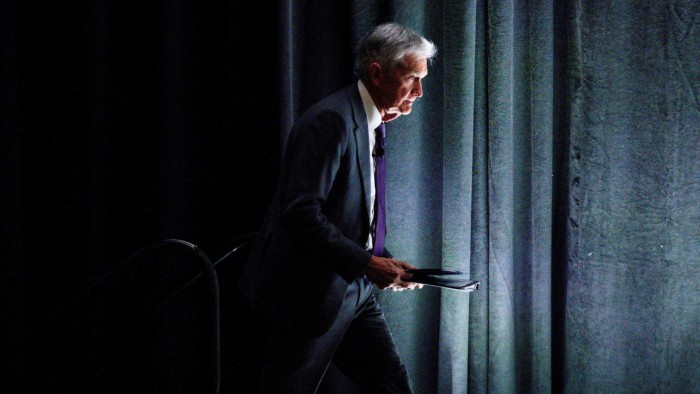

Donald Trump’s claim on Thursday that he has the right to fire Federal Reserve chair Jay Powell has thrust a precedent that has protected independent government agencies for the past nine decades into the spotlight.

The president on Thursday attacked Powell, saying “he’s always too late, a little slow. And I’m not happy with him.” When asked by a reporter in the Oval Office whether he would sack the US’s top central banker, Trump said: “If I want him out, he’ll be out real fast, believe me.”

Trump’s offensive has left investors and economists focused on a case now winding its way through the US courts, which involves his earlier firing of board members at another two independent agencies.

The two officials are far lower profile than Powell, but they were protected by the same 1935 Supreme Court precedent known as Humphrey’s Executor.

Powell said on Wednesday that the Fed was “monitoring” the case, which centres on Trump’s dismissal of Gwynne Wilcox of the National Labor Relations Board and Cathy Harris, Merit Systems Protection Board chair, “carefully”.

What does the case centre on?

The case will test a Supreme Court decision, Humphrey’s Executor vs United States, made 90 years ago, which saw the top US court rule in favour of William Humphrey, a former head of the Federal Trade Commission, over president Franklin D Roosevelt’s decision to remove him in 1933 due to the commissioner’s opposition to New Deal policies.

After Humphrey died, his executor pursued the case to recoup the wages due to his estate, with the Supreme Court deciding that Roosevelt had acted illegally by firing the commissioner without “cause” — a term widely interpreted to cover illegal activities or gross incompetence.

Since then, the ruling has allowed independent agencies — including the Fed — to deflect political pressure when making policy decisions.

Powell, who intends to serve his full term as chair, which runs until May 2026, on Wednesday said the US central bank’s independence to set interest rates as it sees fit was “a matter of law”.

Why is Humphrey’s Executor so important for the US central bank?

The ruling is the biggest legal guardrail preventing Trump from firing Powell or his six fellow Fed governors.

David Wilcox, a former Fed economist now at the Peterson Institute for International Economics, said Humphrey’s Executor has become so important in shaping people’s perceptions of the Fed’s independence that any challenge to it would likely trigger panic.

“The mere empowerment of the president to exercise this ability to fire governors would unnerve market participants, would undermine Federal Reserve credibility in the eyes of investors,” said Wilcox. “We might get a rather severe adverse market reaction to a Supreme Court decision along those lines.”

Why are some Fed watchers becoming concerned?

Wilcox and Harris, Biden administration appointees, were both fired after Trump became president in January. They brought cases against the government in federal courts, which ordered them reinstated.

The Trump administration later appealed to the US Court of Appeals for the District of Columbia, which on April 7 backed the lower courts’ decision to reinstate Wilcox and Harris. The DC Circuit specifically cited the Humphrey’s Executor precedent in its decision.

The US then appealed to the Supreme Court to reverse the lower courts’ order to reinstate Wilcox and Harris.

Chief justice John Roberts on April 9 issued an order that prevents Wilcox and Harris from returning to work while the Supreme Court considers the case. The Supreme Court could decide on the appeal in the coming days. It had required parties to respond to the appeal by April 15.

Lev Menand, a legal scholar at Columbia University, described the circumstances of the case as “extremely rare”, arguing that if the Supreme Court continues to deny the women the right to return to work, then people would probably view Humphrey’s Executor as “doomed”.

“Even though maybe the court in the end will uphold [Humphrey’s Executor] some months from now and put these people back in their jobs, if the court agrees with the government and they get kicked out of their job in the interim period, then, in and of itself, it’s a partial victory for Trump. Even if he loses the case in the end.”

Will the Fed definitely be affected by the case of Harris and Wilcox?

Some legal scholars say the reason Humphrey’s Executor has remained in place for so long is that Supreme Court justices recognise the importance of having an independent US central bank — including conservatives Brett Kavanaugh and Samuel Alito, based on earlier judgments.

Last year, the justices voted 7-2 in a decision that was seen as a measure of the legal support for the Fed’s independence, even though it was officially about the Consumer Financial Protection Bureau. Even Alito, who voted against the funding mechanism for the CFPB, noted in his dissent that the Fed was a “unique institution with a unique historical background” that made it special.

The scholars argue that even if the Supreme Court ends up siding with Trump in the cases of Wilcox and Harris, its judgment could include a carve-out that would insulate Fed governors from political pressure.

“The very first Congress, convening right after the Constitution was ratified, created the First Bank of the United States,” said Daniel Tarullo, a professor at Harvard Law School who was formerly a Fed governor.

“Although the charters of the First and Second Banks were eventually not renewed, their creation set a precedent for an early version of a central bank that was, if anything, more independent of the president than today’s Federal Reserve.”

Powell, who is a lawyer, said on Wednesday that any decision on the case would not “apply to the Fed”.

“Generally speaking, Fed independence is very widely understood and supported in Washington, in Congress, where it really matters,” Powell added.

Additional reporting by Stefania Palma and Joe Miller