Grant Thornton US expands global footprint with roll-up deals

Stay informed with free updates

Simply sign up to the Accounting & Consulting services myFT Digest — delivered directly to your inbox.

Grant Thornton US is in talks to buy more than half a dozen of its sister firms in Europe and the Middle East in a private equity-driven acquisition spree that will dramatically reshape the accounting firm’s global network.

The roll-up plan, some details of which are expected to be announced this week, comes amid intensifying competition between mid-tier accounting firms and is designed to give Grant Thornton an edge in pitching to multinational businesses.

Grant Thornton US set international consolidation as a priority after selling a majority stake to a consortium led by New Mountain Capital last year in the biggest private equity takeover of an accounting firm.

In October it sealed a deal to buy Grant Thornton Ireland, but their UK sister firm spurned a takeover offer and sold itself instead to European buyout group Cinven.

In recent days, the US firm had reached agreements to buy Grant Thornton operations in the United Arab Emirates, Luxembourg and the Cayman Islands, said people familiar with the deals. It was also in advanced negotiations to acquire its sister firm in the Netherlands and had talks at various stages with several other territories, the people said.

Unlike multinational companies, global accounting firms are typically structured as a network of locally-owned businesses that share a common brand and agree to abide by a common set of quality standards.

The Big Four — Deloitte, PwC, EY and KPMG — have either consolidated member firms or imposed powerful central bureaucracies to co-ordinate cross-border work, but mid-tier accounting firms have historically been more loosely affiliated. While the local businesses work together to win and serve international clients, the lack of a shared profit pool can limit incentives to co-operate and spread the mounting cost of investing in new technology, critics say.

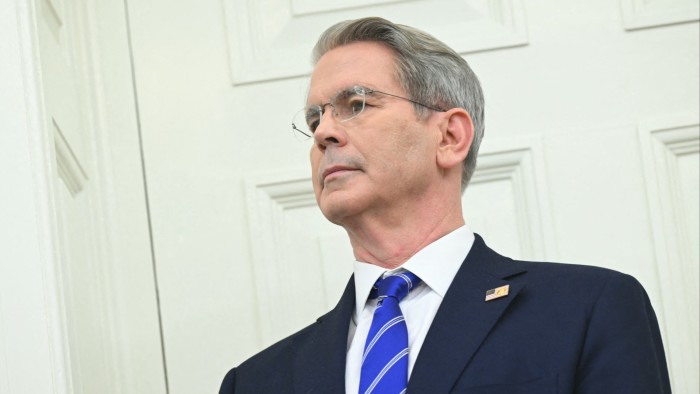

Combining the US and Irish business had “changed behaviour” within the firms and led to a larger number of projects for clients with operations in both countries, said Jim Peko, Grant Thornton US chief executive. “By putting member firms together there is true economic alignment and a seamless client experience.”

The firm was “not looking to consolidate the whole Grant Thornton network”, he added, but would look for countries where major clients had overlapping business interests. Partners of the acquired member firms become equity holders alongside the New Mountain consortium and US partners in a holding company that has been renamed Grant Thornton Global Advisors.

The initial wave of consolidation brings together operations in major financial centres, said Andre Moura, managing director at New Mountain, “but we are just getting started. We plan to bring in the very best, fastest-growing firms.”

The arrival of private equity has rapidly reshaped the US accounting sector, where one in three of the top 30 firms has sold to a financial buyer in the space of four years.

While most firms have used the added financial firepower to buy smaller US accountancies, Grant Thornton was the first to begin consolidating its international sister firms.

RSM US, which has spurned interest from private equity to remain a traditional partnership, said late last year it had reached an agreement in principle to buy its UK counterpart, but the deal is yet to be finalised.