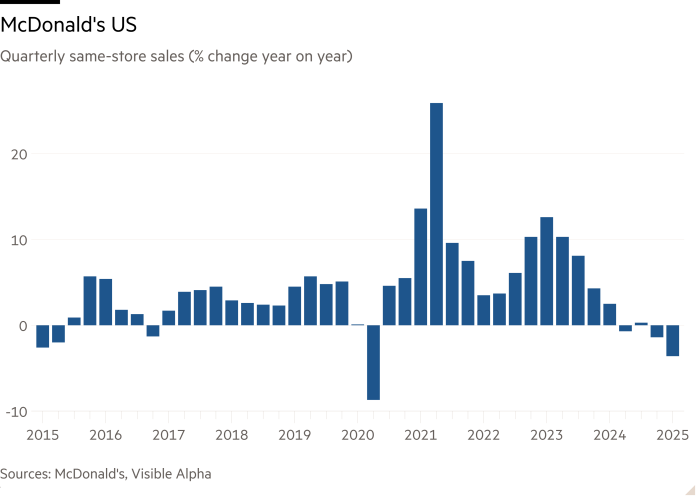

McDonald’s US sales drop by most since height of pandemic

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

McDonald’s has posted the biggest drop in US sales since the height of the Covid-19 pandemic five years ago as uncertainty caused by Donald Trump’s tariffs weighs heavily on consumer sentiment.

Same-store sales in its home market decreased by 3.6 per cent year on year in the quarter that ended in March, driven mainly by lower guest counts, the world’s biggest burger chain said as it released results on Thursday.

The fall in sales at restaurants open for at least a year came as consumer sentiment tumbled late in the quarter after the US president’s levies shook markets and prompted worries among Americans about their employment prospects.

Analysts had expected a more modest 1.4 per cent fall in like-for-like sales at McDonald’s roughly 14,000 US restaurants, according to Visible Alpha. The data marked the second quarter in a row for US comparable sales to decline, and it was the biggest since an 8.7 per cent plunge in mid-2020.

McDonald’s chief executive Chris Kempczinski noted that “consumers today are grappling with uncertainty”.

The data follows weaker US quarterly sales at food and drinks establishments Starbucks and Chipotle Mexican Grill. By contrast, Yum Brands’ Taco Bell US unit reported a 9 per cent increase in same-store sales.

McDonald’s shares have defied the weak stock market to climb more than 10 per cent this year, as investors bet its cheap meals will attract customers during an economic downswing. The US economy contracted by 0.3 per cent over the first quarter, according to data released this week.

The Chicago-based company has continued to extend promotions such as a “$5 meal deal” introduced last summer. It has also rolled out limited-time offers such as the combo of Big Mac, fries, drink and collectible figures tied to the release of A Minecraft Movie this month.

Global comparable sales declined 1 per cent year on year in the first quarter, with weakness in countries including the UK partly offset by stronger sales in markets including Japan and the Middle East. Excluding the extra day in the 2024 leap year, the global sales would have been unchanged in the quarter.

Revenue fell 3 per cent to $5.96bn, missing the $6.12bn estimate in a Visible Alpha poll. Net income also undershot expectations with a 3 per cent fall to $1.87bn.