Toyota warns time running out to challenge China’s lead in hydrogen vehicles

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Toyota’s hydrogen chief has warned that vehicles powered by the green fuel could suffer the same fate as battery-powered electric cars, with Chinese groups rapidly dominating supply chains and exports unless other countries step up investment in the technology.

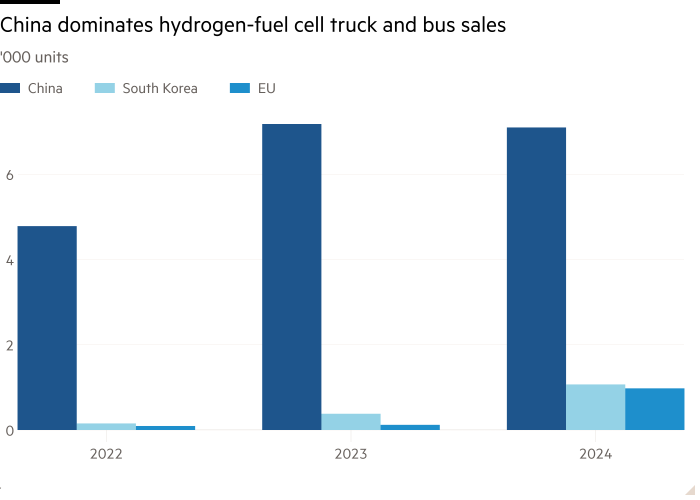

Mitsumasa Yamagata, president of the Japanese carmaker’s hydrogen arm, said China was taking a lead in infrastructure for hydrogen trucks, reducing fuel costs to a third of Japan’s and rapidly building refuelling stations. China already accounts for most of the world’s hydrogen commercial vehicle sales.

“All stakeholders moving at once is the most important thing for bringing the cost of hydrogen down,” Yamagata said. “China is the most advanced in the world for hydrogen trucks. Why they’re that advanced is because the Chinese government ordered turning major logistics routes into hydrogen highways.”

Hydrogen fuel cells — which create electricity through a chemical reaction with oxygen, emitting only water vapour — offer great promise for long-haul transport because batteries are considered too heavy and require too much recharging for commercial vehicles.

Asian carmakers including Toyota and South Korea’s Hyundai have bet on hydrogen as a fuel of the future, even as battery-powered vehicles take off and narrow the market opportunity for the colourless gas.

But simultaneously realising cheap, clean fuel production, building refuelling stations and producing low-cost hydrogen cars has proved tough. The future of major infrastructure projects is in doubt as costs have ballooned and subsidies are deemed to be insufficient.

US funds for hydrogen projects are at risk of being cut under President Donald Trump, Japan’s plans for its own hydrogen highways and subsidies to import the fuel have been slow-moving, and auditors have called the EU’s goal to produce and import 10mn tonnes of renewable hydrogen by 2030 “unrealistic”.

Even in China, hydrogen’s role in commercial transport is not assured. Battery electric truck and bus sales have been growing rapidly, helping zero emission commercial vehicle sales double to a record high of 230,000 in 2024, according to the International Council on Clean Transportation.

Yamagata said battery and hydrogen cars were technologies in a “transition period”, but battery-powered vehicles were pushing grids to breaking point and unsuitable for trucking heavy loads across long distances, requiring several decarbonisation solutions.

China’s sales of hydrogen fuel-cell buses and trucks in 2024 were higher than all other regions of the world put together, at 7,069 units, according to data provider Interact Analysis.

Chinese state media last month touted the launch of the country’s first cross-region hydrogen truck route spanning 1,150km between Chongqing and the southern port of Qinzhou.

Hydrogen in China costs between ¥500 and ¥1,000 ($3.50 and $7) per kilogramme versus ¥2,000 in Japan, said Yamagata, although part of that advantage is due to producing the fuel as a byproduct in steelmaking.

Toyota’s hydrogen chief said China’s lead was not unassailable, but urgent action was needed. “We don’t have much time left — it’s important to accelerate quickly,” he said.

Toyota, the world’s largest carmaker by sales, has been the industry’s foremost proponent of hydrogen vehicles, developing the technology for more than 30 years and selling 28,000 Mirai fuel-cell cars since its launch in 2014. BMW and Honda are also pursuing the technology.

While Toyota has wound back its expectations for hydrogen revolutionising the car market in the near term as battery EV sales take off, the Japanese group has pivoted towards making its fuel-cell technology succeed in the truck and bus markets.

It recently unveiled its third-generation hydrogen fuel cell that lasts as long as a diesel engine and can be installed as a single unit in commercial vehicles, helping to reduce costs.

Toyota believes its hydrogen bet will pay off like its multi-decade pursuit of hybrid vehicles did. In China, it plans to battle for market share through joint ventures with local companies. Last year, it opened a factory in Beijing with SinoHytec that can produce up to 10,000 fuel-cell systems a year.

Yamagata said Toyota would use the Chinese market as a “dojo” to work on its technology before rolling it out to the rest of the world.

“By refining our products in China’s tough market environment, we will release competitive products in Japan, Europe and the US afterwards,” he said.