Proxy adviser ISS backs Elliott in fight against Phillips 66

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Activist investor Elliott Management has won the backing of influential proxy adviser Institutional Shareholder Services for all four board nominees in its campaign against oil refiner Phillips 66, according to a report seen by the Financial Times.

The recommendation from ISS, which advises big money managers such as BlackRock over how to vote in proxy votes, gives Elliott the upper hand in a shareholder proxy battle expected to climax at Phillips 66’s annual meeting later this month.

ISS on Monday recommended that Phillips 66’s shareholders vote in favour of Elliott’s four board nominees instead of the refiner’s candidates. Elliott’s nominees include former ConocoPhillips executives Brian Coffman and Sigmund Cornelius as well as former Targa Resources executive Michael Heim and ex-Citadel energy analyst Stacy Nieuwoudt.

“Although the board has been reshaped since the pandemic, important industry perspectives have been overlooked, and there is strong evidence that the board is not willing to exercise independent oversight of management,” said the ISS report.

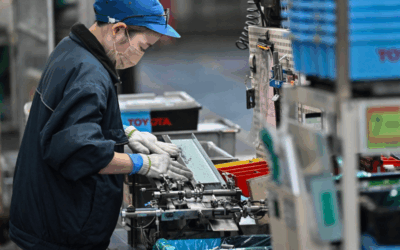

In one of its most contentious fights in recent years, Elliott has been pushing Phillip 66 investors to back its demand that the Houston-based refiner sell assets, improve performance at its refining business and overhaul corporate governance.

After first investing in Phillips 66 in 2023, Elliott more than doubled its stake to $2.5bn earlier this year, complaining that the oil refiner had failed to deliver on earlier promises, including installing two independent directors. Instead it only added one, former Cenovus Energy executive Bob Pease.

ISS’s recommendation comes after Glass Lewis, another proxy adviser, backed three of Elliott’s nominees on Saturday, as well as Phillips 66’s candidate. Shareholders will vote at the annual meeting on May 21. Only four of the 14 board positions are up for nomination because the company’s board election is staggered over a three-year period.

In its report, ISS also raised concerns about corporate governance at Phillips 66, criticising its staggered board elections and questioning Pease’s status as an independent director after he voted in favour of the company’s decision to hand chief executive Mark Lashier the role of chair.

“The severity of the disconnect with shareholders was underscored by the board’s decision to recombine the chair and CEO positions last year. These and other failures indicate a pressing need for more independence on the board,” said ISS, adding that Elliott had presented “a compelling case for change”.

Shares in Phillips 66 stood at just over $118 on Thursday, giving it a market value of $45bn. In its campaign, Elliott has highlighted how the company’s performance in recent years had lagged industry peers Valero Energy and Marathon Petroleum.

Previous Elliott proxy fights, including against oil and gas company Hess and air carrier Southwest Airlines, were settled at the eleventh hour before a vote took place.

Elliott declined to comment. Phillips 66 and ISS did not immediately respond to requests for comment.