Reeves considers changes to non-dom inheritance tax amid UK ‘exodus’

Unlock the Editor’s Digest for free

Roula Khalaf, Editor of the FT, selects her favourite stories in this weekly newsletter.

Chancellor Rachel Reeves is exploring reversing a decision to charge UK inheritance tax on the global assets of non-doms, following a spate of departures and lobbying by the City of London, according to government officials and financiers briefed on the discussions.

The exposure of worldwide assets to inheritance tax at 40 per cent — which came into force in April — is the element of scrapping the non-dom regime that is “causing most heartburn”, one government official said. The Treasury is reviewing the decision, they added.

Another official confirmed the Treasury would change the inheritance tax regime for non-doms if it was found to be good for Britain’s international competitiveness.

One senior financier who is in frequent contact with Reeves said the government is trying to find a way of “backtracking without backtracking” on the non-dom changes — with a particular focus on the inheritance tax issue.

A second senior City figure said that “there will most likely be some tweaks to inheritance tax to stop the non-dom exodus”.

The ending of the non-dom regime — and the Labour government’s decision to close a loophole allowing the use of offshore trusts to avoid inheritance tax — has caused a wave of wealthy people to leave the UK for more tax-friendly regimes such as the United Arab Emirates, Italy and Switzerland.

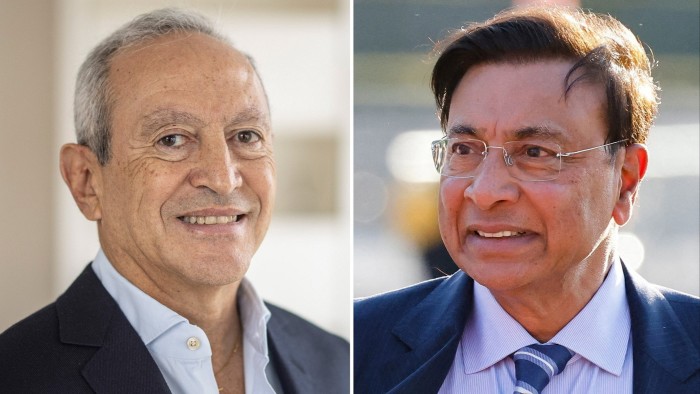

Steel billionaire Lakshmi Mittal and Nassef Sawiris, Egypt’s richest man, are among those to have either left the UK or who are planning to because of the abolition of the non-dom regime.

The Treasury said: “The government will continue to work with stakeholders to ensure the new regime is internationally competitive and continues to focus on attracting the best talent and investment to the UK.”

The abolition of the non-dom regime — first announced by the previous Conservative government — was confirmed by Reeves in her October Budget, when she also announced the closure of the trusts “loophole”.

The chancellor is said by allies to be “listening” to representations from the City on the issue. “We aren’t complacent,” said one. “We want to make sure Britain is an attractive place to be. We are getting a lot of feedback.”

Some of that feedback is being passed on by Varun Chandra, the Number 10 business adviser, and Jonathan Reynolds, business secretary, both of whom regularly have their ears bent on the issue by international investors.

Alastair King, the Lord Mayor of the City of London, is among those making the case for changes to the Treasury after raising concerns about the threat to the City from a combination of the abolition of the non-dom regime, changes to inheritance tax, and the removal of VAT exemption on private school fees.

One broker said that collectively the changes had caused pain for “lots of people in the City, not just billionaires”.

However, any retreat on the non-dom regime would be problematic for Reeves, coming after a U-turn over plans to strip winter fuel payments from 10mn pensioners. She is also in the process of cutting £5bn of sickness and disability benefits.

Any change in the regime would normally come in the Budget that is expected in the autumn.

Yet some in government believe Reeves will not give ground on the issue. “We won’t do it, the politics are dreadful,” said one Labour adviser. Another senior Labour official said the crackdown on non-doms was “one of our most popular policies”.

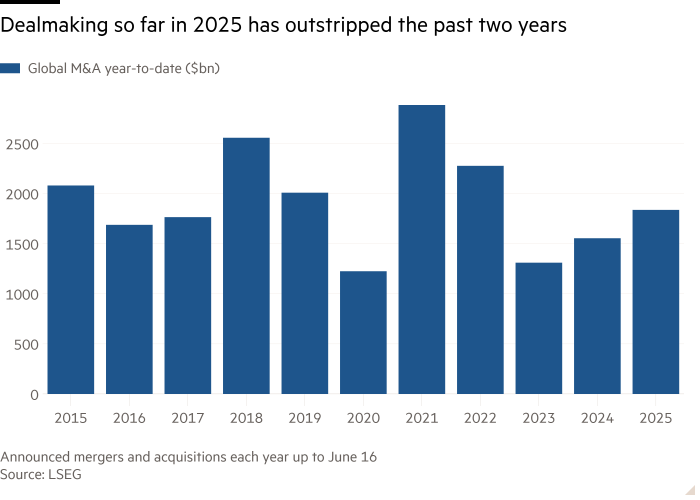

In opposition, had originally estimated that ending the tax break on trusts would bring in £430mn a year. However, the Office for Budget Responsibility in October estimated the measure will bring in just £200mn a year in 2029-30.

Advisers said that Reeves’ surprise move to reform agricultural property relief and business property relief in last year’s Budget was also prompting the departure of British business owners.

The change means that those with large estates or significant companies that were previously exempt will pay inheritance tax at 20 per cent on assets above £1mn from April 2026.

Ceri Vokes, co-head of the private client and tax team in Europe at law firm Withers, said changes to business property relief need to be reversed to prevent a “further exodus of business owners from the UK”.

She added: “By forcing people to leave the UK, you don’t get 20 per cent of the value of their business, you get 0 per cent.”

Additional reporting by Josh Spero, Emma Agyemang and Ashley Armstrong