How a $1.4tn Trump trade war could unfold

Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

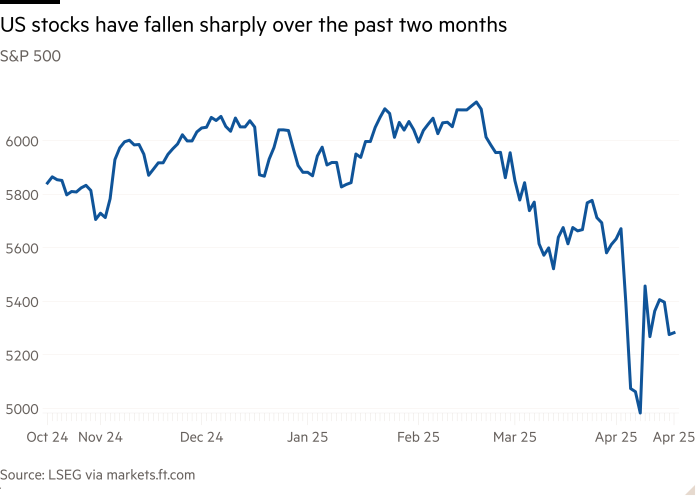

A trade war triggered by President Donald Trump applying a 25 per cent tariff on all imports could cause a $1.4tn hit to the world economy and dramatically drive up US prices, according to a new study modelling the fallout from a retaliatory spiral.

Econometric analysis of a worst-case scenario, where US trade partners hit back against Washington, shows a Trump-inspired tariff war would cause widespread trade disruption, rising prices and falling living standards.

The study by economists at Aston University in the UK examines how a tariff tit-for-tat forces complex shifts in global commerce, starting in North America between the US, Mexico and Canada, before spilling out into Europe and then the rest of world.

It remains highly uncertain at what level Trump will set “reciprocal” tariffs this Wednesday on what he has called “Liberation Day” — and how affected nations and trade blocs will respond.

To depict the potential fallout, the model examines six escalating scenarios, using bilateral trade data from 132 countries in 2023.

Although some nations might benefit from so-called trade diversion effects as trade patterns shift to avoid tariffs, the overall impacts are negative when the trade war expands.

Jun Du, a professor of economics at Aston University, said the modelling showed that if countries imposed 25 per cent tariffs on each other it would have similar effects to the 1930 trade war that deepened the Great Depression.

“These findings align with historical precedents like the Smoot-Hawley tariffs and modern trade conflicts, illustrating how protectionism erodes competitiveness, disrupts supply chains, and imposes disproportionate costs on consumers,” she wrote.

In the hypothetical scenario where the war is confined to Canada, Mexico and China responding with a 25 per cent tariff against Trump-imposed tariffs, all sides experience a sharp drop in trade of more than 30 per cent.

The contraction in trade leads to increased inflation, and has a negative impact on “economic welfare”, measured in real terms per capita GDP. But the US suffers less than Mexico and Canada, reflecting the balance of power in the economic relationship.

In that scenario, the hit to US economic welfare is predicted at 1.1 per cent — compared with a 7 and 5 per cent reduction respectively for Mexico and Canada, with the negative effects playing out over five to 10 years.

But in a full-blown global trade war, where partners retaliate to match Trump tariffs, the US would experience the worst inflationary effects of any nation, according to the research.

That scenario would cause “significant disruptions to international trade and economic activity”, the analysis warns, with US exports falling by more than 43 per cent.

Some countries, such as Ireland, which has a narrow trading relationship with the US that relies on highly integrated supply chains used in products such as pharmaceuticals, are found to be disproportionately at risk.

While Ireland experiences a small uptick in exports and imports as a result of a limited Canada-Mexico-US trade war, that gain flips to a 6.6 per cent drop in exports and nearly 13 per cent fall in imports, in the event of a US-EU trade war.

Du said that Ireland’s less diversified trade base when compared with larger countries, which have deeper commercial relationships with China, left it more vulnerable to being “caught in the crossfire” between the world’s biggest economies.

Similar impacts are expected on big US trade partners such as South Korea, which is especially reliant on car exports.

The research found that the post-Brexit UK had the potential to take advantage of its more agile trade policy outside the EU. But it warned that UK unilateral action could “strain its relationship” with Brussels and hurt integrated EU-UK supply chains.

“The study reaffirms that no economy emerges unscathed from systemic tariff escalations, as retaliatory spirals fracture multilateral co-operation and amplify global instability,” Du concludes.