Nvidia blindsided by Trump’s curbs in multibillion-dollar blow to China sales

Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

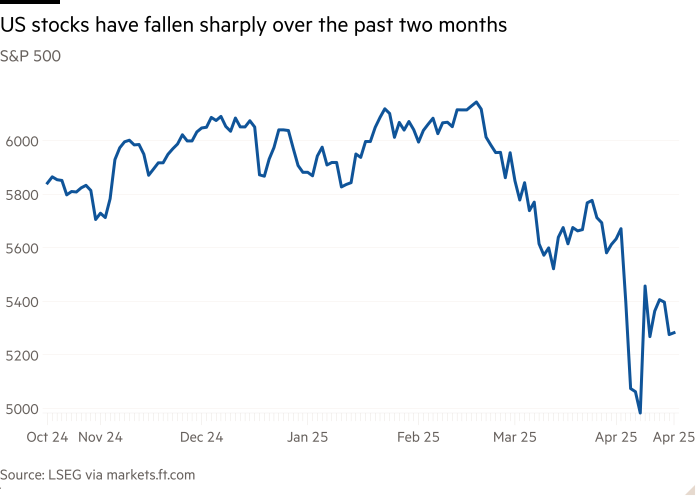

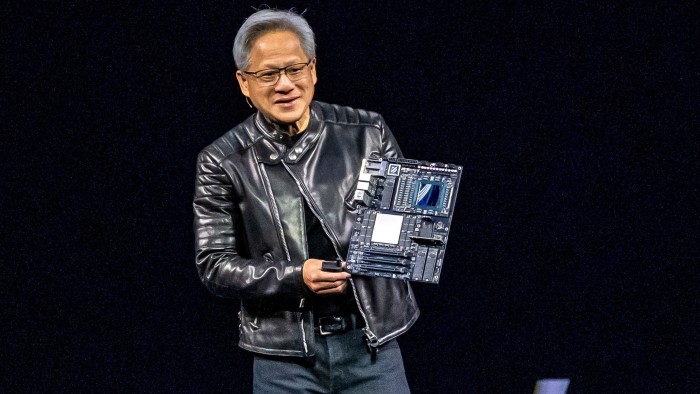

Nvidia has been caught by surprise by Donald Trump’s new export controls on its best-selling artificial intelligence chip in China, leaving the chipmaker and its clients to assess the damage caused by the US president’s latest salvo in an escalating trade war.

The $2.7tn semiconductor giant revealed a $5.5bn charge on Tuesday night related to new US controls on its sales to China, while industry insiders believe the hit on Nvidia’s revenue could reach more than $10bn.

The US chipmaker Intel, under chief executive Lip-Bu Tan, told its Chinese clients last week that sales of some of their advanced artificial intelligence processors would start to require a licence, according to a company email reviewed by the Financial Times and people with knowledge of the discussions.

According to two people with knowledge of the situation, Nvidia had thought its H20 graphics processing unit — a less powerful version of its AI chips designed to meet Washington’s previous export controls — could potentially be exempted from the requirement.

After a meeting with Trump at his Florida residence at Mar-a-Lago earlier this month, Nvidia executives were left with the impression they could escape tougher enforcement of any curbs, the people said, adding the company’s plan to invest $500bn in the US had also impressed the president.

This led Nvidia to tell Chinese clients, including tech giants Alibaba, ByteDance and Tencent, that orders of H20s would not be affected, the people said.

Nvidia was then blindsided as Trump decided to clamp down on the export of H20, a product that Chinese tech groups have relied upon in their efforts to challenge their global peers to develop large language models.

Frustrated Chinese tech companies have complained about not having enough warning about such a major policy change, but are understanding that the shift is beyond the control of Nvidia, according to the people with knowledge of recent discussions.

AI demand jumped in China after DeepSeek’s successful launch of its low-cost reasoning model led local companies to put in almost $17bn orders for H20 chips this year, according to one of the people.

While Nvidia typically takes more than six months to deliver such chips, most of this year’s orders from its Chinese clients are yet to be filled and will probably be affected by the latest US restrictions.

The $5.5bn hit to earnings Nvidia announced are mostly the cost of materials to be used to produce such orders and related penalties and operational costs for not delivering based on agreed terms. The actual affected revenue from China could be more than $10bn, the person estimated.

China’s tech giants are racing to find a replacement to the H20, while Trump’s new export controls could significantly help the sales of domestic manufacturers led by Huawei, which has been pushing to produce more AI processors.

It also remains unclear how Chinese groups can apply for a licence to obtain H20s and on what basis would they be issued.

Intel told its Chinese clients last week that chips which would require a licence for exporting to China if they have: a total DRam bandwidth of 1400 gigabytes per second or more; I/O bandwidth of 1100 GB per second or more; or a total of both of 1700 GB per second or more, according to a company email. Intel’s Gaudi series as well as Nvidia’s H20 far exceed these requirements.

Nvidia declined to comment. Intel, the White House and US commerce department did not immediately respond to requests for comment.

Additional reporting by Demetri Sevastopulo in Washington

This story has been amended to reflect that Lip-Bu Tan is chief executive of Intel