Republican senator backs Powell over Trump attacks on Fed

Unlock the White House Watch newsletter for free

Your guide to what the 2024 US election means for Washington and the world

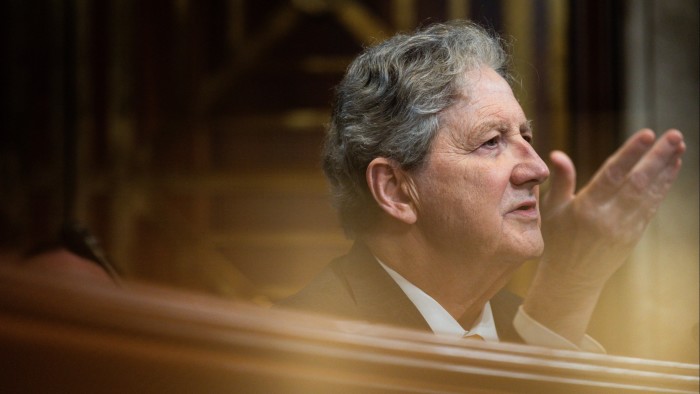

A Republican member of the Senate committee that oversees the Federal Reserve has hit out at Donald Trump’s attacks on Jay Powell, saying no president has the authority to fire the head of the US central bank.

“I don’t think the president, any president, has the right to remove the Federal Reserve chairman,” John Kennedy, a Louisiana Republican who sits on the Senate banking committee, said on NBC on Sunday. “I think the Federal Reserve ought to be independent.”

The remarks come just days after Trump signalled he believes he does have the authority to fire Powell, telling reporters in the Oval Office on Thursday: “If I want him out, he’ll be out real fast, believe me.”

Relations between the US president and the central bank chair he nominated have become increasingly strained in the face of the Fed’s reluctance to cut interest rates since Trump returned to the White House in January.

Rate-setters, including Powell, say Trump’s tariffs threaten to dent growth and raise prices — placing the Fed in what its chief on Wednesday described as a “challenging scenario” in which it would be forced to defend its inflation-fighting credentials above all else.

The remarks by the Fed chair, who has vowed to remain in office until the end of his term in May 2026, led Trump to take to Truth Social on Thursday to say that “Powell’s termination cannot come fast enough!”

Kennedy on Sunday defended the Fed’s focus on keeping inflation in check, saying: “My experience with Jay Powell is that he’s got tiger blood. He’s going to do what he thinks is right, and he’s not going to go down in history as the Federal Reserve chairman that allowed inflation to become wild as a March hare, and he’s going to do what he thinks he’s got to do.”

Inflation in personal consumption expenditures hit its highest level since the early 1980s in 2022 and remains above the central bank’s 2 per cent goal at 2.5 per cent.

Some officials at the central bank think tariffs could drive annual price rises back up to as high as 5 per cent later on this year — should Trump reintroduce levies on the scale announced on April 2.

Austan Goolsbee, president of the Chicago Fed, said on CBS on Sunday that many businesses were doing “pre-emptive purchasing” of products that could be affected by tariffs, meaning “activity might look artificially high” before a drop-off in the summer.

When asked about Trump’s attacks on Powell, Goolsbee noted that in countries where central bank independence had been challenged “the inflation rate is higher, growth is slower, the job market is worse”.

“I strongly hope that we do not move ourselves into an environment where monetary independence is questioned,” Goolsbee said. “That would undermine the credibility of the Fed.”