Gloomy mood ahead of IMF and World Bank spring meetings

Hello and welcome to the working week.

It feels that now is a good time to be an economist, or at least someone with an iota of knowledge about economics. And this week a lot of such people will be in Washington for the annual IMF and World Bank spring meetings. Economics will be earning its moniker of the dismal science given the current Trump tariff trauma. There will be global growth forecasts updated and much discussion about the impact of trade wars and the actions of the US president.

IMF managing director Kristalina Georgieva, who is scheduled to give a press briefing on the global policy agenda, is clearly concerned. Earlier this month she said that her Washington-headquartered agency was still assessing the macroeconomic implications of Trump’s tariff plans, but that “it is important to avoid steps that could further harm the world economy”.

Talking of which, remember that this Wednesday is FT Live’s Unhedged event. Register here to join FT experts for an in-depth analysis of the current market turmoil and longer-term impact of the trade war.

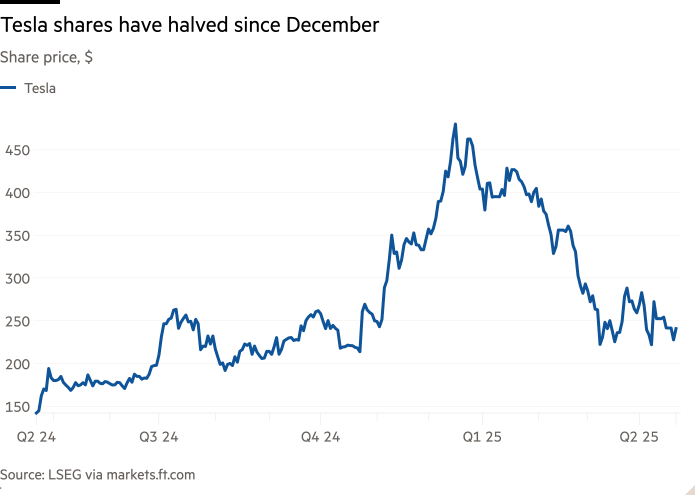

The corporate announcements crank up again after the Easter break. Big Tech will be a theme with results from Elon Musk’s Tesla and Google owner Alphabet. The former has already reported its worst quarter for sales since 2022 so investors — especially those still fuming at Musk’s $56bn bonus — will be keen to know how this has impacted the bottom line when Tesla reports first-quarter figures on Tuesday.

The economic data reports are fairly thin, but more than compensated for by the speeches from central bankers, both a result of the happenings in Washington this week. The latest purchasing managers’ index (PMI) reports will be pored over for signs of the impact of US tariffs, especially in the European manufacturing gauges, which have been recovering in recent months. Full details of this and the other items below.

One more thing . . .

Where is the hope? Well, it can be found on the streets of the British capital this coming Sunday as the London Marathon is back in town. As I might have mentioned, I’ve run this race but this year will be happy to stand on the sidelines, helping provide some relief for the families of those who’ve come to watch runners as a volunteer at an adventure playground that I chair which happens to be situated along the route. The FT’s excellent Globetrotter section has a guide to running clubs for those interested in seeking a place in next year’s street race.

Economic and company reports

Here is a more complete list of what to expect in terms of company reports and economic data this week.

Monday

-

IMF and World Bank spring meetings begin in Washington, concluding on Saturday

-

Australia, Canada, France, Germany, Hong Kong, Italy, UK: Easter Monday holiday. Markets closed

-

Israel: updated Q4 GDP estimate

-

Results: Comerica Q1, WR Berkley Q1

Tuesday

-

IMF World Economic Outlook report published

-

G24 ministers and central bank governors meet at the IMF headquarters in Washington, followed by a press conference

-

South Korea: March producer price index (PPI) inflation rate data

-

Results: 3M Q1, Capital One Financial Q1, City of London Investment Group Q3 funds under management announcement, Danaher Q1, Equifax Q1, Getinge Q1, Halliburton Q1, HCL Technologies Q4, Lockheed Martin Q1, Moody’s Q1, Northern Trust Q1, RTX Q1, SAP Q1, Temenos Q1, Tesla Q1, Verizon Communications Q1

Wednesday

-

IIF Global Outlook Forum, held alongside the IMF and World Bank spring meetings in Washington. Speakers include Bank of England governor Andrew Bailey and European Central Bank executive board member Philip Lane

-

Bank of England chief economist and executive director for monetary analysis Huw Pill speaks at Leeds University Business School

-

Federal Reserve Bank of Chicago president and chief executive Austan Goolsbee delivers opening remarks in a virtual presentation at the Federal Reserve Bank of Philadelphia’s 2025 Economic Mobility Summit

-

EU, France, Germany, India, Japan, UK, US: S&P Global manufacturing and services purchasing managers’ index (PMI) data

-

UK: March public sector finances data

-

US: Federal Reserve’s Beige Book

-

Results: AB Dynamics HY, AkzoNobel Q1, AT&T Q1, Babcock International FY post-close trading update, BE Semiconductor Besi Q1, Baker Hughes Q1, Boeing Q1, Chipotle Mexican Grill Q1, Foxtons Q1 trading update, Fresnillo Q1 production report, General Dynamics Q1, Heathrow Q1 trading statement, IBM Q1, Nichols AGM trading update, PensionBee Q1 trading update, Philip Morris International Q1, Randstad Q1, Reckitt Benckiser Q1 trading update, Shimano Q1, Texas Instruments Q1, UMC Q1, Western Union Q1

Thursday

-

Bank of England deputy governor Clare Lombardelli speaks on sidelines of IMF meetings in Washington

-

Germany: Ifo survey

-

Japan: March services PPI inflation rate data

-

Results: Alphabet Q1, Asos HY, BNP Paribas Q1, Bristol Myers Squibb Q1, Comcast Q1, Dassault Systemes Q1, Delivery Hero Q1 trading update, Eni Q1, Hasbro Q1, Inchcape Q1 trading update, Intel Q1, Keurig Dr Pepper Q1, Merck & Co Q1, Nasdaq Q1, Nokia Q1, PepsiCo Q1, Procter & Gamble Q3, Sanofi Q1, STMicroelectronics Q1, Trelleborg Q1, Unilever Q1 trading statement, Union Pacific Q1

Friday

-

Australia, New Zealand: Anzac Day. Financial markets closed.

-

Japan: Tokyo consumer price index (CPI) inflation rate data

-

UK: March retail sales figures for Great Britain

-

Results: AbbVie Q1, Advantest FY, Centene Q1, Charter Communications Q1, Colgate-Palmolive Q1, HCA Healthcare Q1, LyondellBasell Q1, Schlumberger Q1

World events

Finally, here is a rundown of other events and milestones this week.

Monday

-

Egypt: Sham Ennesim festival, celebrating the start of spring, originating from the ancient Shemu festival and in modern times coinciding with Easter Monday

-

UK: Gatwick airport operations staff continue their industrial action, likely to increase disruption for travellers returning from Easter breaks

-

US: 129th Boston Marathon, the world’s oldest annual marathon, coinciding with Patriot’s Day, celebrated as a holiday in half a dozen states to commemorate the first battles of the American Revolutionary War

Tuesday

-

Earth Day, raising awareness of renewable energy needs

-

US: A federal judge in Manhattan will hold a hearing to consider extending his block on the Trump administration’s deportation of Venezuelan migrants under the Alien Enemies Act

Wednesday

-

US: G20 finance ministers and central bank governors meet in Washington

-

St George’s Day celebrations in various countries

-

UK: Turner Prize 2025 shortlist announced

Thursday

-

China: National Day of Space Flight, on the day in 1970 when the country launched its first man-made earth satellite, Dongfanghong-1

-

France: eighth annual Cannes international TV festival begins

-

UK: The International Energy Agency and the government host a major international energy security summit at Lancaster House in London. Opening remarks will be delivered by energy security and net zero secretary Ed Miliband

Friday

-

North Korea: Military Foundation Day

-

Australia/New Zealand: Anzac Day. A service of commemoration and thanksgiving will be held at London’s Westminster Abbey to honour the anniversary of the Gallipoli landings in 1915 by allied forces

-

US: The National Rifle Association begins its annual meeting in Atlanta, Georgia, concluding on Sunday

Saturday

-

UK: Just Stop Oil holds its final demonstration in Westminster, having announced last month that it was ending its campaign of civil resistance

-

US: White House Correspondents’ Association annual dinner, during which the president traditionally pokes fun at himself in a light-hearted sketch